SILICIE (Suministro Inmediato de Libros Contables de Impuestos Especiales – immediate submission of accounting records for excise duties) is a project of the Spanish Tax Agency that will change the accounting method for products subject to excise duties.

The new regulation entered into force on 1 January 2020 and requires factories (including vinegar factories), warehouses and bonded warehouses to keep accounts of the products subject to excise duties, through the electronic office of the Tax Agency, by submitting the accounting entries electronically. However, due to the WHO’s declaration of COVID-19 as a pandemic, the deadlines established by which the facilities subject to SILICIE must submit the 2020 accounting records electronically have been extended to 15 January 2021.

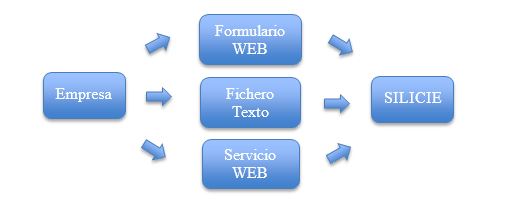

SILICIE allows you to choose between two methods for submitting the information: Directly from the electronic office or by using a computerised internal accounting system. For the latter, the tax agency granted a moratorium of 6 months for submission of the accounting entries.

What must be submitted in the SILICIE?

The accounting must reflect all the processes, movements and stocks related to the products subject to excise duties and, if applicable, the raw materials necessary to obtain them, that is, all movements that represent an increase or decrease in stock.

For example: Product purchases, truckload for route sales, reintroduction of the loads for route sales, direct sales and any other accounting adjustment recorded.

When are they to be submitted?

The time limit for submission of the accounting entries is 8 working days after the date the movement is entered in the accounting system; if you still have not started sending information to SILICIE on 1 January 2020, you have until 15 January 2021 to submit all the accounting entries corresponding to 2020.

However, it is important to keep in mind that after 1 January 2021, the time limit for submission is reduced to 5 days.

The Tax Agency considers three dates relative to each accounting entry:

- Movement date: Date the operation took place (for example, date of a load for route sales)

- Accounting date: Date on which the operation was recorded in the computer system (in the previous example, the date on which we enter the load). This date may not be more than 24 hours after the movement date.

- Submission date (in SILICIE): in the previous example, date on which we enter the load in SILICIE.

Modification of accounting entries

Cancellation of accounting entries in SILICIE is allowed, however, modification of accounting entries is NOT allowed. That is, to modify an already-submitted entry we must cancel the submission of the entry we need to modify, modify the accounting entry and resubmit it.

It should be noted that the regulation is aimed at tax fraud and is based on the obligations of the Royal Decree which can be consulted at the following link:

https://www.boe.es/boe/dias/2018/12/29/pdfs/BOE-A-2018-17995.pdf

Comments